Is Mueller investigating whether Deutsche Bank may have sold Trump Organization debts to sanctioned Russian banks?

- Get link

- X

- Other Apps

After multiple outlets reported that Mueller had subpoenaed Deutsche Bank’s records on Trump’s accounts, Trump reportedly attempted to fire Mueller, only to pull back when Mueller’s team told him those reporters were inaccurate. A U.S. official has, however, told Reuters that Mueller is investigating whether Deutsche Bank may have sold Trump Organization debts to sanctioned Russian banks. (Neither Deutsche Bank nor the Russian banks contacted by Reuters commented on whether such a transaction was made.)

A quick refresher on some of the key points of the Trump-Deutsche Bank saga, now that The New York Times has reported that the president invoked his former business relationship with Justin Kennedy as part of a sustained effort to urge his father to retire:

As the Trump Organization limped through the 1990s and 2000s, Deutsche Bank was one of the only financial institutions willing to lend to him.

- Other big banks have long refused to lend to him, reportedly coining the term “the Donald risk” to refer to his repeated bankruptcies and failures to repay loans. However, Deutsche Bank, whose real-estate division continued to lend him hundreds of millions of dollars to finance his projects, seemed to have a greater risk appetite.

- Despite being a disastrous credit risk at Deutsche Bank as well, the relationship continued: Struggling to repay a $640 million loan after the 2008 financial crash, Trump instead sued a group of lenders led by the bank for $3 billion their roles in causing the crisis, only for Deutsche Bank to countersue for an unspecified amount.

- The cases were ultimately settled—and Deutsche Bank reopened its line of credit with Trump, who still owes the bank hundreds of millions of dollars, through its private-wealth-management side.

- Justin Kennedy not only held a senior executive position at Deutsche Bank but reportedly worked closely with Trump through this bizarre and tumultuous time, departing the firm soon after in 2009.

- Others in Trump’s orbit have also benefited from a relationship with Deutsche Bank; his son-in-law and top adviser Jared Kushner’s floundering real-estate empire has also received massive loans from Deutsche Bank, including $285 million one month before the 2016 election.

Trump has consistently labored to keep his finances opaque, but has been especially averse to any investigation of his Deutsche Bank activity.

- Trump once told The New York Times he considers investigating his and his family’s finances “a red line” and “a violation”, but Mueller has not stopped looking into the Trump Organization.

- One move in particular seemed to trigger an outsized response: After multiple outlets reported that Mueller had subpoenaed Deutsche Bank’s records on Trump’s accounts, Trump reportedly attempted to fire Mueller, only to pull back when Mueller’s team told him those reporters were inaccurate. A U.S. official has, however, told Reuters that Mueller is investigating whether Deutsche Bank may have sold Trump Organization debts to sanctioned Russian banks. (Neither Deutsche Bank nor the Russian banks contacted by Reuters commented on whether such a transaction was made.)

Meanwhile, Deutsche Bank has recently faced multiple scandals over its business practices in Russia.

- During the 2000s, Deutsche Bank worked closely with Russian state institutions that have since come under U.S. sanctions. (Whether these relationships continued after the sanctions were enacted is unknown, and Deutsche Bank is not known to have commented on the relationships.)

- In 2015, Deutsche Bank’s Russian arm was implicated in the “mirror trading” scandal, a $10 billion Russian money-laundering scheme, leading international oversight bodies to fine Deutsche Bank more than $600 million, which Deutsche Bank paid in January 2017. The bank has since signed a consent order and is cooperating with ongoing investigations.

- Earlier this month, Bloomberg reported another line of inquiry into Deutsche Bank’s activities in Russia—namely, that internal investigators are looking into whether the company attempted to curry favor with Russian officials by hiring their children. (The former executive at the center of the probe, who has since left the company, denies any improper behavior; the bank has not commented.)

- Deutsche Bank has also reportedly loaned at least $90 million to Prevezon, a Russian company (represented by the June 9 Trump Tower meeting attendee Natalia Veselnitskaya) that recently settled a massive money-laundering case with the U.S. government. Deutsche Bank was not implicated in the fraud, and Prevezon has not admitted wrongdoing.

There are more details on Trump orbit interactions with Deutsche Bank here, including their placement in our overarching timeline.

Read the whole story

· · ·

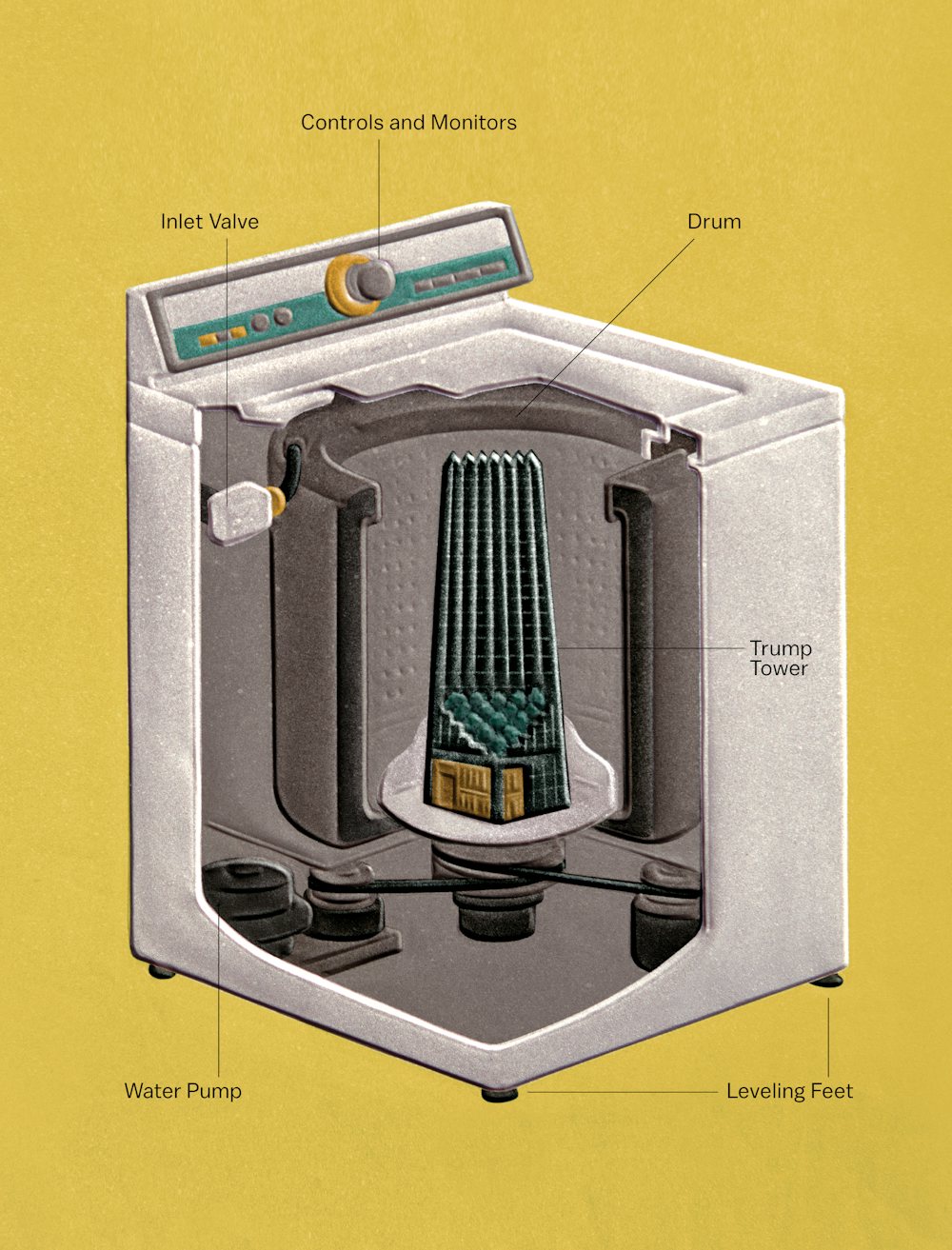

The president’s favorite financial institution.

By Krisztian Bocsi/Bloomberg/Getty Image.

Among the many mysteries surrounding Donald Trump’s finances as a real-estate mogul—and the conflicts of interest that might be revealed by his tax returns, were he ever to release them—is his long history of debt. The issue is not merely what Trump owes, but who he owes. As critics noted on the campaign trail, Trump’s habit of reneging on contracts and suing his lenders meant that virtually nobody on Wall Street wanted to work with him, with one exception: Deutsche Bank, which had loaned him hundreds of millions of dollars when no one else would, even after he sued the firm. Now, investigators probing the ties between the Trump campaign and Russia are wondering why—and they’re beginning to take a closer look at the president’s accounts with his favorite bank, which also happens to have strong ties to Russia itself.

The New York Times reports that banking regulators are currently “reviewing hundreds of millions of dollars in loans made to Mr. Trump’s businesses through Deutsche Bank’s private wealth management unit . . . to [see] if the loans might expose the bank to heightened risk.” Meanwhile, the Guardianreports that executives at Deutsche are “expecting that the bank will soon be receiving subpoenas or other requests for information from Robert Mueller,” and that the special counsel’s investigative team and the bank have “already established informal contact in connection to the federal investigation.”

There’s certainly plenty to look into. Over the last 20 years, Trump has received more than $4 billion in loan commitments and potential bond offerings from the German lender, despite suing the company in 2008 when he fell behind on payments on the $640 million loan he was given to build Trump International Hotel & Tower in Chicago. Incredibly, in order to avoid paying the $40 million he had personally guaranteed, Trump and his lawyer argued that “Deutsche Bank is one of the banks primarily responsible for the economic dysfunction we are currently facing”—i.e. the global financial crisis—and therefore it should pay him $3 billion in damages under the extraordinary event clause in his contract. Naturally, the bank countersued, calling the real-estate developer’s claim “classic Trump.” In the end, after threatening to take his name off the building if he wasn’t granted more time to pay, the bank gave Trump extra time; when he did pay the money he owed to the firm’s real-estate lending division, it was with another loan he got from Deutsche’s wealth-management unit. Trump subsequently moved his business from the real estate group to the private wealth management group, where, according to the Times, “executives were more willing to deal with him.” One of those executives was Rosemary Vrablic,who has helped finance three Trump properties over the last six years, lending $300 million in the process. That amount is “somewhat unusual by Wall Street standards,” former and current Deutsche Bank executives and wealth managers at other firms on Wall Street told the Times.

In addition to Donald, Ivanka Trump is also said to be a Deutsche Bank client, as is Jared Kushner and his mother, who, per the Times, have “an unsecured line of credit from Deutsche Bank, valued at up to $25 million.” In addition, the Kushner family business, Kushner Companies, got a $285 million loan from the bank last year. And because the Kushners and Trumps have never shied away from conflicts of interest, in 2013, Kushner reportedly “ordered up a glowing profile of [Vrablic] in the real estate magazine he owned,” with a disclosure about their connection at the very end of the piece.

Apart from the Trumps and Kushners, Deutsche Bank also has deep ties to Russia. In addition to settling allegations earlier this year that it allowed $10 billion to be laundered out of Eastern Europe, Deutsche Bank had a “cooperation agreement” with Vnesheconombank, a Russian state-owned development bank that is the target of U.S. economic sanctions. Vnesheconombank, for those who need a refresher, was the bank whose chief executive, Sergey Gorkov, Jared Kushner forgot to mention meeting in December. Oh, and there’s also this:

. . . in May, federal prosecutors settled a case with a Cyprus investment vehicle owned by a Russian businessman with close family connections to the Kremlin. The firm, Prevezon Holdings, was represented by Natalia Veselnitskaya, the Russian lawyer who was among the people who met during the presidential campaign with Donald Trump Jr. about Hillary Clinton. Federal prosecutors in the United States claimed Prevezon, which admitted no wrongdoing, laundered the proceeds of an alleged Russian tax fraud through real estate. Prevezon and its partner relied in part on $90 million in financing from a big European financial institution, court records show. It was Deutsche Bank.

In an interview with the Times published late Wednesday night, Trump, when asked if he thought Mueller’s investigation would “cross a red line” if it began to examine his “family’s finances beyond any relationship to Russia,” said “I would say yes. I think that’s a violation.”

Follow to get the latest news and analysis about the players in your inbox.

See All Players

MARTHA STEWART

Photo: Photo-Illustration by Ben Park; From NBC/Getty Images (Stewart).

The domestic doyenne, known primarily for teaching a whole class of homemakers the virtues of a perfectly-timed soufflé or a perfectly-folded sheet, imperfectly found herself in the Big House for five months in 2004, after she was convicted for conspiracy and obstruction of justice related to selling shares of drugmaker ImClone Systems.

MARTIN SHKRELI

Photo: Photo-Illustration by Ben Park; From Getty Images (Shkreli).

The so-called “pharma-bro” created a national media frenzy when he hiked the price of a lifesaving drug by 5,000 percent overnight in 2015, and continued to fan the flames by buying a $2 million single-copy Wu-Tang Clan album and picking fights with presidential candidates. In the midst of the firestorm, he also got arrested and charged with 8 counts of fraud after prosecutors accusing him of using a public drug company he ran as a personal piggybank to pay back investors whose money he lost at his now-defunct hedge funds.

BERNIE MADOFF

Photo: Photo-Illustration by Ben Park; From Getty Images (Madoff).

The name Bernie Madoff has become synonymous with reprehensible greed after the Wall Street fraudster was caught stealing his victims’ fortunes to live like a king. Madoff was sentenced to 150 years in prison—the maximum for his crimes—after pleading guilty to 11 counts of myriad financial crimes related to a Ponzi scheme that swallowed up $10 billion of investors’ money.

ALLEN STANFORD

Photo: Photo-Illustration by Ben Park; From Getty Images (Stanford).

In the early 2000s, Allen Stanford was enjoying the spoils of a $7 billion Ponzi scheme—a knighthood awarded by Antigua, a handful of yachts, $2 billion to his name, and a cricket team of his very own. But the international fraud empire he built over the course of two decades, in which he offered phony high-interest certificates of deposit at a bank he started in Antigua, imploded. He was charged with 13 counts of wire and mail fraud, conspiracy, and money laundering and sentenced to 110 years in prison without parole.

MATHEW MARTOMA

Photo: Photo-Illustration by Ben Park; From Splash News (Martoma).

Over the course of several days in July of 2008, Mathew Martoma sealed his fate. That was when the former S.A.C. Capital portfolio manager allegedly used inside information about a clinical trial for Alzheimer’s drugs to bring in a windfall for his firm. Martoma was one of about 85 individuals who were either convicted of or pleaded guilty in the ensuing investigation that rocked Wall Street, though Martoma’s 9-year sentence was on the harsher side. A judge ruled that he also had to forfeit nearly $9.5 million in bonuses he received while working at S.A.C. in 2008, including the Boca Raton home he bought for $2 million.

SAGE KELLY

Photo: Photo-Illustration by Ben Park; From Splash News (Kelly).

By Wall Street standards, Sage Kelly had it all: a cushy, $7 million-a-year gig running Jefferies’s health-care investment-banking unit, a home in Sag Harbor, a growing family, and a group of buddies to pal around with. But it all came crashing down when his wife filed for divorce, alleging in court papers that they had engaged in a foursome with clients and that he would often take so many drugs that he would pee all over their home. Jefferies denied all of the allegations and Kelly’s wife later recanted the statements, but the banker found himself out of a job for two years.

BRUNO IKSIL

Photo: Photo-Illustration by Ben Park; From Getty Images (Iksil).

Bruno Iksil earned himself the moniker the “London Whale” for a $6.2 billion trading loss he made on J.P. Morgan’s ledger in 2012. The Frenchman, who contends that his risky trades were made at the behest of his superiors, avoided any sort of prosecution. But the bank was subject to government probes and $900 million in regulatory fines, and its C.E.O., Jamie Dimon, took a 50 percent pay cut.

Read the whole story

· · · · · ·

Next Page of Stories

Loading...

Page 2

Next Page of Stories

Loading...

Page 3

- Get link

- X

- Other Apps

.jpg)

Comments

Post a Comment