6:30 AM 1/9/2019 - Did Deutsche Bank sell Trump's debt to Sberbank? Would it mean that he is "owned" by Russia? - M.N. | "Had Deutsche sold any part of Trump's debt to foreign entities?" - The Sydney Morning Herald-Dec 30, 2017

- Get link

- X

- Other Apps

- Had Deutsche sold any part of Trump's debt to foreign entities?

- What meetings had the bank held with the Trump administration?

- Had Trump or his family received preferential treatment?

- Who decided to carry on lending to Trump after he defaulted in 2008?

- Had Russia or Russian entities underwritten any aspect of these loans?

- Was Deutsche shielding the President because of the Justice Department's ongoing investigation into mirror trades?

Every inquiry, question, and query came up against a wall...

Did Trump accept Russian sources of funding during these times? Richard Dearlove, the former head of MI6, said this question hangs over the President. Dearlove told the magazine Prospect: "What lingers for Trump may be what deals - on what terms - he did after the financial crisis of 2008 to borrow Russian money when others in the West would not lend to him."

It wasn't just Donald Trump who maintained a warm relationship with Deutsche. The German bank looked after his entire family. Jared Kushner, Ivanka, and Kushner's mother Seryl Stadtmauer were all Deutsche clients."

Mysterious triangle: Donald Trump, Deutsche Bank and the Kremlin ...

The Sydney Morning Herald-Dec 30, 2017

The fed-up reproving parent was Deutsche Bank, Trump's New York creditor. .... stocks from Deutsche Bank Moscow in companies like Gazprom or Sberbank. ... Had Deutsche sold any part of Trump's debt to foreign entities?

"Our best guesses would be that we're either dealing with one of Russia's fake-ass state-owned money laundering banks, like VneshEconomBank, which Jared Kushner has had very weird contactswith. It could be Sberbank, which is also state-owned; which is Putin's favorite for money laundering (allegedly, as if he'd so such a thing!); which sponsored Trump's Miss Universe pageant in Moscow in 2013; and which was at one point supposedly going to provide financing for the Moscow Trump Tower project that never happened. You know, the one Trump was trying to make happen during the presidential campaign while repeatedly lying about it in public."

What's That Robert Mueller Secret Grand Jury Subpoena Fight About ...

Wonkette (blog)-Dec 19, 2018

If we unfairly elided things together and suggested Mueller is investigatingsomething we ... Somebody who went to some dumb party at the Trump hotel was just ... It could be Sberbank, which is also state-owned; which is Putin's favorite for ...

"Our best guesses would be that we're either dealing with one of Russia's fake-ass state-owned money laundering banks, like VneshEconomBank, which Jared Kushner has had very weird contactswith. It could be Sberbank, which is also state-owned; which is Putin's favorite for money laundering (allegedly, as if he'd so such a thing!); which sponsored Trump's Miss Universe pageant in Moscow in 2013; and which was at one point supposedly going to provide financing for the Moscow Trump Tower project that never happened. You know, the one Trump was trying to make happen during the presidential campaign while repeatedly lying about it in public."

Natalia Veselnitskaya's indictment, explained

Vox-16 hours ago

Natalia Veselnitskaya — the Russian lawyer who infamously met with Donald Trump Jr. and top Trump campaign officials at Trump Tower ...

Russian lawyer Natalia Veselnitskaya charged with obstruction in ...

International-Business Insider-18 hours ago

International-Business Insider-18 hours ago

Russian who attended Trump Tower meeting charged with obstruction ...

In-Depth-The Guardian-15 hours ago

In-Depth-The Guardian-15 hours ago

Russian lawyer connected to Trump Tower meeting charged with ...

The National-3 hours ago

Natalia Veselnitskaya is being investigated by Special Counsel ... Natalia V. Veselnitskaya, has been indicted for obstruction of justice in a case ...

US claims Russian lawyer Natalia Veselnitskaya who gave Trump dirt ...

<a href="https://en.crimerussia.com/" rel="nofollow">https://en.crimerussia.com/</a>-1 hour ago

<a href="https://en.crimerussia.com/" rel="nofollow">https://en.crimerussia.com/</a>-1 hour ago

Russian Lawyer Natalia Veselnitskaya Charged In Money Laundering ...

International-ClickLancashire-6 hours ago

International-ClickLancashire-6 hours ago

Russia's Veselnitskaya Charged With Obstructing Laundering Probe

Bloomberg-18 hours ago

Natalia Veselnitskaya, a Russian lawyer who met with Trump campaign officials in June of 2016, was charged in the U.S. with obstructing an ...

Russian lawyer in Trump Tower meeting charged

CNN-18 hours ago

The US attorney in Manhattan has charged Natalia Veselnitskaya, the Russian lawyer who met in Trump Tower with Donald Trump Jr. and ...

Russian lawyer in Trump Tower meeting charged in separate case

Irish Times-14 hours ago

Natalia Veselnitskaya, who attended the June 2016 meeting at Trump Tower, ... Ms Veselnitskaya (43), who lives in Russia, was an attorney for ...

Read the whole story

· · ·

How Russian Money Helped Save Trump's Business

Foreign Policy-Dec 21, 2018

In truth Trump was all but finished as a major real-estate developer, in the ... By the early 1990s he hadburned through his portion of his father Fred's ... in 1999 and was financed by two German lenders, Deutsche Bank and .... Bayrock sold the debt-ridden mogul on the idea of launching an international ...

How's China's Opening to the Financial Sector Going?

Washington Post-9 hours ago

But the take-up by foreign companies has been slow. ... Foreign-ownership caps on banks and bad-debt managers -- 20 percent ... Citigroup, Goldman Sachs, Bank of America and Deutsche Bank all sold their minority stakes in Chinese ... U.S. President Donald Trump accuses China of being a one-sided ...

Foreign Banks Get a Break From IRS in Trump Tax Law's New Levy

Bloomberg-Dec 13, 2018

Foreign Banks Get a Break From IRS in Trump Tax Law's New Levy ... a major new international tax aimed at preventing global companies ... to the entire payment, firms will only have to pay the tax on a portion of it, ... HSBC Holdings Plc, Mizuho Financial Group Inc. and Deutsche Bank AG havedisclosed ...

Deutsche Bank targeted by Dems over Trump ties

The Hill-Dec 19, 2018

Deutsche Bank is facing a perilous 2019 with fresh scrutiny from Democratic ... is investigating the Trump Organization's business activities in Russia as part of his broader ... Is his financial interest guiding his foreign policy? ... that he had debts totaling $360 million through his companies to DeutscheBank.

Strange real estate deal raises specter of Putin buying Trump

San Francisco Chronicle-Dec 13, 2018

He sold a mansion in Palm Beach for $95 million to Dmitry ... The sale price was nearly $54 million more than Trump had paid for ... He was unable to make payments on a Deutsche Bank loan for ... He had personally guaranteed $40 million of that debt. ... The stock price of Rybolovlev's company soared.

Read the whole story

· · ·

Next Page of Stories

Loading...

Page 2

Donald Trump inside the under-construction Trump International Hotel in Washington in March 2016. In 2014, Deutsche Bank agreed to lend the Trump Organisation up to $US170 million to finance the gut renovation of the hotel. Credit:ZACH GIBSON

One had to be a little awed by Trump's nose-thumbing response. Instead of paying up, he counter-sued.

He argued that Deutsche Bank had co-created the financial downturn. Or as he put it: "Deutsche Bank is one of the banks primarily responsible for the economic dysfunction we are currently facing."

Therefore, he was not obliged to pay back any money.

Therefore, Deutsche Bank owed him money. He wanted $US3 billion in damages.

Donald Trump at the Taj Mahal casino in Atlantic City in 1996, one of a string of bankruptcies in the 1990s that alienated him from major US lenders.Credit:CHESTER HIGGINS JR

The same day he argued that the depression meant he was off the hook, Trump gave an interview to The Scotsman newspaper. After a two-year fight, he had succeeded in getting approval from the Scottish government for a new Trump golf resort near Balmedie in Aberdeenshire.

"The world has changed financially and the banks are all in such trouble, but the good news is that we are doing very well as a company and we are in a very, very strong cash position," Trump told the newspaper.

Anshu Jain, right, and Juergen Fitschen, then co-chief executives of Deutsche Bank, during a news conference in Frankfurt in 2013.Credit:RALPH ORLOWSKI

Trump's outrageous behaviour vis-a-vis Deutsche Bank might have been anticipated. He was, after all, someone who had been through a slew of corporate bankruptcies. His Taj Mahal casino, his other casinos in Atlantic City, his Plaza Hotel in NYC all filed for chapter 11 bankruptcy in the early 1990s.

After those failures, US banks that had previously advanced the capital to Trump for building projects, believing them to be sound investments, stopped lending. Chase Manhattan, Citibank, and other burned Wall Street houses declined further credit and refused his calls.

The Trump National Doral resort in Florida, which Deutsche Bank's private wealth wing allowed Trump to mortgage twice.Credit:ILANA PANICH LINSMAN

The one institution willing to advance him loans in the new century was Deutsche Bank.

In 2010 Trump settled his feud with Deutsche. This was done, extraordinarily, by borrowing more money from … Deutsche Bank.

The Trump International Hotel in Washington, which Deutsche Bank's private wealth wing helped pay for.Credit:AL DRAGO

Shut out from its real estate division, Trump turned to another part of the same institution - Deutsche's private wealth division, which typically deals with high net worth individuals. It doesn't normally do property. Still, the unit lent him the money. And later gave him another $US25 to $US50 million in credit.

Asked whether it was normal to give more money to a customer who was a bad credit risk and a litigant, one former senior Deutsche staff member said: "Are you f---ing kidding me?"

Robert Mueller, the Justice Department's special counsel, in Washington in June.Credit:DOUG MILLS

Remarkably, Trump was able to borrow even bigger sums. He took out two mortgages against his Trump National Doral resort in Miami. And a $US170 million loan to finish his hotel in Washington in the old post office tower. These loans flowed from the private wealth wing.

According to an analysis by Bloomberg, by the time he became the 45th president, Trump owed Deutsche Bank around $US300 million. All four debts were due in 2023 and 2024. This was an unprecedented sum for an incoming president and one that raised awkward questions about conflict of interest. If Deutsche Bank were to get into regulatory difficulty, one of the bodies that would investigate was the Department of Justice. Which reported to Trump. It was hard to see how the department could work dispassionately. Or how Deutsche might take legal action against a sitting president if he defaulted again.

Collusion by Luke Harding.Credit:NEW YORK TIMES

From Russia to New York: the Deutsche connection

During the same period Deutsche was doing something abnormal - something that would provoke the interest of regulators, and in turn lead to punishment. The bank was laundering money. Russian money. Not small amounts but many billions of dollars. This dubious tide flowed from Moscow to London, and from London to New York.

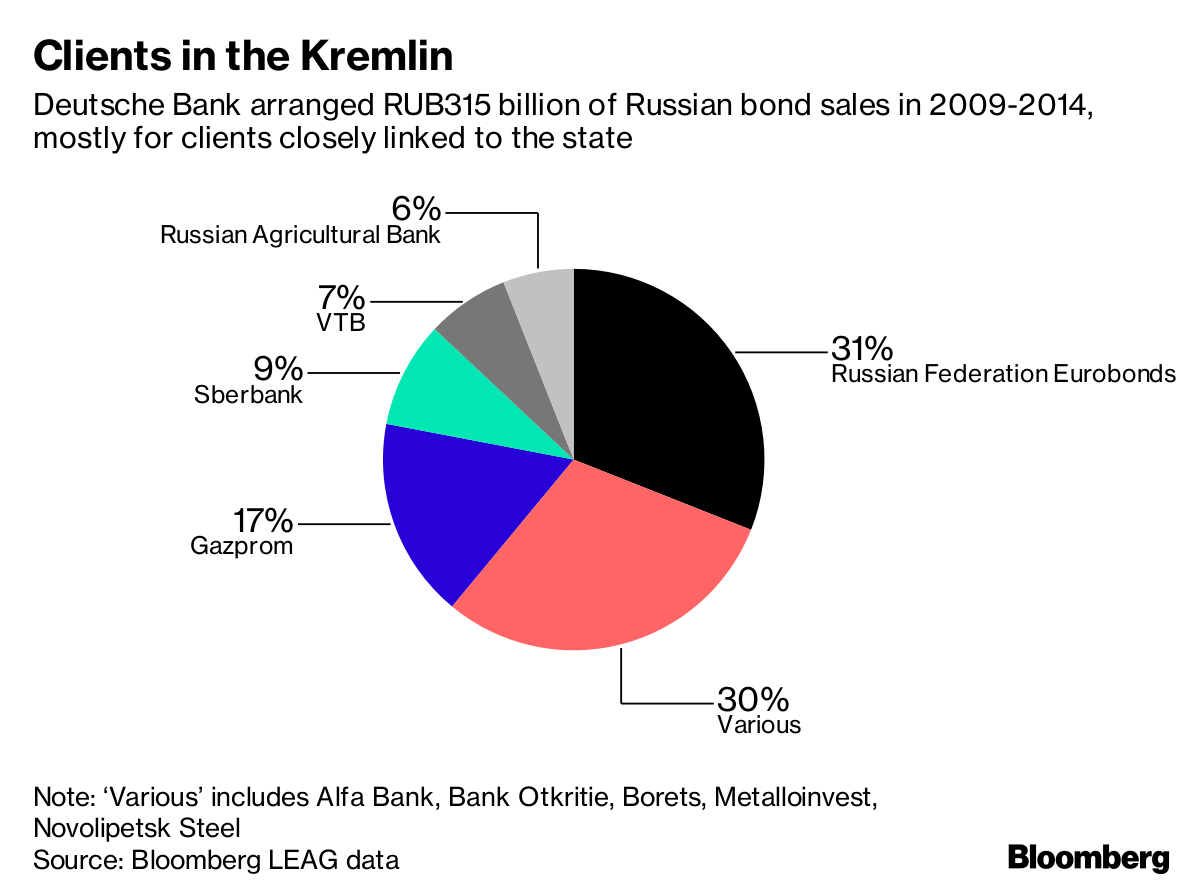

In 2005 Deutsche bought UFG, a boutique investment bank already well established in Moscow. The man behind Deutsche's aggressive expansion was Anshu Jain, its future co-chief executive. Jain came up with a controversial strategy: to tap into potentially huge Russian profits, he decided to forge relationships with state partners.

Former head of MI6 Richard Dearlove in 2008.Credit:AP

Russia's most powerful banker was Andrey Kostin. Kostin had served in Sydney and London as a Soviet diplomat. Intelligence sources think he was a KGB spy. In the 1990s, he became head of Vnesheconombank - VEB - a state development bank described by one former CIA analyst as the "Kremlin's cookie jar".

Then Putin made Kostin head of Vneshtorgbank, or VTB, also state-run.

Jain and Deutsche Bank recruited Kostin's twenty-something son, also called Andrei, with an i. In spring 2007 Kostin jnr moved from a posting in London to Deutsche Bank in Moscow. Suddenly, he got massive flows of business.

According to one estimate, Deutsche Bank's Moscow subsidiary began notching up profits of $US500 million to $US1 billion a year, with VTB generating somewhere between 50 and 80 per cent of all revenue. In Moscow, a Russian client bought blue-chip Russian stocks from Deutsche Bank Moscow in companies like Gazprom or Sberbank. The payment was in roubles. The size of a typical order was $US2 million to $US3 million. Shortly afterwards a non-Russian "customer" sold exactly the same number of securities to Deutsche Bank in London, paying in dollars.

These "mirror trades" were fake and had no economic logic. The selling parties were based in offshore territories like Cyprus or the British Virgin Islands. Billions were moved out of one Deutsche Bank, from its modern glass office at Building 2, 82 Sadovnicheskaya Street, to another Deutsche Bank, at 60 Wall Street. There were nearly 6000 transactions. Nobody in New York or London or Frankfurt or any of the international financial centres really noticed.

The end came in August 2015, when Deutsche Bank suspended American Tim Wiswell and then fired him. After that, he disappeared. There were Facebook postings from South-east Asia and Bali, where the Wiswells went with their two small children. He appeared to be on the run from US authorities and is now allegedly back in Moscow. One friend described him to The New Yorker as "finance's Edward Snowden".

In a wrongful dismissal suit Wiswell said he'd been scapegoated. Around 20 colleagues, including two senior managers in London, knew all about the trades, he said.

The affair was a grievous blow to Deutsche Bank's reputation. The New York State Department of Financial Services (DFS) - which has the power to suspend any bank with a branch in New York - fined Deutsche $US475 million. London's Financial Conduct Authority imposed a £163 million ($282.2 million) penalty. The bank carried out an internal review, Project Square.

The review did not identify the Russians behind the scheme. We don't know who they were or where the billions went. Or where the money came from in the first place.

A Kremlin bank, VTB, had seemingly captured Deutsche Bank's Moscow outpost. Deutsche's London and New York divisions were economic beneficiaries of this arrangement. While this was going on, Deutsche Bank in New York lent hundreds of millions of dollars to the future president. What Democratic senators and representatives wanted to know was this: Was there a connection? It was a good question.

Family ties

My attempts to get information from Deutsche Bank over its lending to Trump were unsuccessful. House and Senate Democrats fared no better.

There were legitimate things to ask. Such as:

- Had Deutsche sold any part of Trump's debt to foreign entities?

- What meetings had the bank held with the Trump administration?

- Had Trump or his family received preferential treatment?

- Who decided to carry on lending to Trump after he defaulted in 2008?

- Had Russia or Russian entities underwritten any aspect of these loans?

- Was Deutsche shielding the President because of the Justice Department's ongoing investigation into mirror trades?

Every inquiry, question, and query came up against a wall.

Overall, Germany's largest bank was in trouble. In 2005 the DFS reprimanded the bank for rigging the LIBOR, the main interbank lending rate. There was a further fine for sanctions busting - processing dollar transactions on behalf of entities in Iran, Libya, Syria, Myanmar and Sudan. And another $7.2 billion for selling high-risk mortgage-backed securities before the 2008 slump.

Did Trump accept Russian sources of funding during these times? Richard Dearlove, the former head of MI6, said this question hangs over the President. Dearlove told the magazine Prospect: "What lingers for Trump may be what deals - on what terms - he did after the financial crisis of 2008 to borrow Russian money when others in the West would not lend to him."

It wasn't just Donald Trump who maintained a warm relationship with Deutsche. The German bank looked after his entire family. Jared Kushner, Ivanka, and Kushner's mother Seryl Stadtmauer were all Deutsche clients.

The Puck Building in New York, which securities filings show is involved in loans the Kushner Companies received from Deutsche Bank.Credit:New York Times

According to our sources inside Deutsche, Trump's bid to become president made him a politically exposed person, or PEP. Deutsche reviewed its lending to Trump and his relatives, and the review was sensitive. Its goal was to discover if there was a Russian connection to Trump's loans. The DFS also requested information.

The sources insist that the answer was negative. No trail to Moscow was ever discovered, they told us. Deutsche, however, refused to make public comment. Nor would it provide details of its private review to Capitol Hill. Senators wrote letters; the bank stonewalled, citing privacy rules. Congress showed interest in mirror trades. It got the same evasive nein.

In a letter to Bill Woodley, Deutsche's US chief executive, senator Chris Van Hollen expressed concerns about the bank's lending to Kushner. Kushner had a $US25 million line of credit with Deutsche. Additionally, in October 2016, it loaned him $US285 million. The loan was made around the time when Kremlin representatives were eagerly seeking Kushner's ear.

Kushner first met Sergey Kislyak in April, when Trump gave his foreign policy speech at DC's Mayflower Hotel - just a handshake and pleasantries, Kushner said. Next came the meeting with Natalia Veselnitskaya. Then, on November 16, Kislyak got in touch again. By this point it was clear that Kushner would become senior adviser to the president.

Kremlin-linked lawyer Natalia Veselnitskaya met with Donald Trump jnr and Jared Kushner.Credit:AP

The Kushner-Kislyak meeting on December 1 took place at Trump Tower. Michael Flynn was present, too. Kushner made an unusual proposal. He asked Kislyak if it would be possible to set up a secret and secure communications channel between the Trump transition team and the Kremlin. The purpose, seemingly, was to keep any conversations hidden from the outgoing Obama administration and US intelligence.

Could this be done, Kushner wondered, by using Russian diplomatic facilities in the United States?

The inquiry was staggeringly naive. If Kushner or Flynn were to drop by the Russian embassy, then US intelligence would certainly notice. The FBI didn't bug the conversation but learned of it afterwards, when Kislyak reported to his superiors back in Moscow. According to FBI intercepts of Russian communications, Kislyak was taken aback by Kushner's unusual request.

Russia, it seemed, didn't need to expend much effort to get close to Trump's aides. Kislyak came up with a suggestion of his own. Perhaps Kushner would like to meet with another person from Moscow, someone with "a direct relationship" to President Putin?

Jared Kushner: courted by Russian officials as a fixed point in the otherwise volatile Trump team.Credit:New York Times

The details were agreed during a meeting on December 12 between Kislyak and Kushner's assistant, Avi Berkowitz. Putin's emissary turned out to be a banker, or more accurately, a banker-spy. His name was Sergei Gorkov. He was the head of VEB, the state development bank, which Kostin had run and whose board Putin had chaired during his four years as prime minister.

Gorkov had trained in the 1990s at the academy of the FSB [the successor to the KGB in handling state security], before joining the state-run Sberbank. Like VTB, Sberbank performed certain Kremlin functions. It was the official sponsor of the 2013 Miss Universe contest in Moscow, attended by Trump and hosted by Aras Agalarov. Eight days after the contest Sberbank announced it was lending Agalarov 55 billion roubles ($1.25 billion) to finance new projects. One of those under consideration was Trump's Moscow tower.

Russian businessman Aras Agalarov, left, with Miss Universe Gabriela Isler and Donald Trump in Moscow in November 2013.Credit:Kommersant via AP

VEB provided capital to build facilities at the Sochi Olympics and cash to secessionist rebels in eastern Ukraine. These top-down ventures lost money. VEB had large debts. The United States had included VEB, VTB and Sberbank in its 2014 sanctions package - the same package that led Putin to ban US couples from adopting Russian children. Gorkov's job was to restore the bank's fortunes.

Gorkov was well prepared for his meeting with Kushner. He flew in from Moscow. On his plane were gifts. These were a piece of art and some earth carefully dug up and transported from the town of Novogrudok in north-west Belarus.The town was where Kushner's paternal grandmother, Rae Kushner, grew up.

This subtlety was wasted. In evidence, Kushner said Putin's messenger had given him a "bag of dirt". It came from "Nvgorod," he wrote, spelling his grandmother's birthplace incorrectly.

Kushner characterised the encounter as brief, meaningless. Next Gorkov flew directly from New York to Japan, where Putin was attending a summit. The banker would have certainly reported to his boss.

Aras Agalarov, right, with Russian President Vladimir Putin and Kremlin chief manager Vladimir Kozhin in Vladivostok in 2012.Credit:AP

Targeting Kushner was logical. He was soon to become a federal employee. His portfolio included tax, banking policy, the military and international affairs. In a protean White House - where anyone could be fired - Kushner's status as the President's son-in-law made him unsackable.

During his meetings with Russians, Kushner said nothing about Moscow's attack on US democracy.

Read the whole story

· · · · · · · · · · ·

The Trump-Russia Timeline

Just Security-Dec 19, 2018

Russia defaults on its debt and its stock market collapses. ... Efforts to sell Russians apartments in Trump World Tower, Trump's West Side condominiums and Trump's building on Columbus .... TrumpSues Deutsche Bank, But Bank Keeps Lending To Him Anyway ...... Sberbank's CEO does not show up for the address.

Mysterious triangle: Donald Trump, Deutsche Bank and the Kremlin ...

The Sydney Morning Herald-Dec 30, 2017

The fed-up reproving parent was Deutsche Bank, Trump's New York creditor. .... stocks from Deutsche Bank Moscow in companies like Gazprom or Sberbank. ... Had Deutsche sold any part of Trump's debtto foreign entities?

Is Donald Trump's Dark Russian Secret Hiding in Deutsche Bank's ...

Newsweek-Dec 21, 2017

Is Donald Trump's Dark Russian Secret Hiding in Deutsche Bank's Vaults? ... Deutsche was seeking an immediate $40 million from the client, plus interest, ... to pay back his debts, he gave an interview to The Scotsman newspaper. .... from Deutsche Bank Moscow in companies like Gazprom or Sberbank.

Donald Trump's debt to Deutsche Bank

Financial Times-Aug 30, 2017

When Donald Trump sued Deutsche Bank in late 2008, it was “classic Trump”, .... In addition, the bank could sell them extra services through its .... the Trump SoHo hotel, and several Russian banks, including Sberbank, ...

Trump lawyer denies Deutsche Bank got subpoena on Trump accounts

Reuters-Dec 5, 2017

He later said the bank in question was Deutsche Bank. ... was to find out whether Deutsche Bank may have sold some of Trump's mortgage or other ... request, had one been received,” responded a representative of Sberbank (SBER.MM). Holding Trump debt, particularly if some of it was or is coming due, ...

Mueller reportedly subpoenaed Deutsche Bank for information on ...

International-Business Insider-Dec 5, 2017

International-Business Insider-Dec 5, 2017

Putin Pays Price for Sanctions as Government Bond Sales Scrapped

Bloomberg-Apr 10, 2018

It's the first debt auction Russia abandoned since cancellations in ... a London-based emerging-markets trader at Investec Bank Plc. "My ... When the ruble went into freefall in December 2014, she did just that ... auction, Sberbank PJSC postponed a local bond sale because of the "negative market dynamic.

Sberbank: the bank trying to shape Russia's future

Financial Times-Sep 29, 2018

... that limit access to international debt markets since 2014, the bank has ... The child of an ethnic German family exiled to central Asia by Stalin, Mr Gref, 54, ... Having visited Sberbank branches across Russia, Mr Gref was shocked .... bank's share price fell nearly 20 per cent in April during a mass sell-off.

Read the whole story

· · ·

After multiple outlets reported that Mueller had subpoenaed Deutsche Bank’s records on Trump’s accounts, Trump reportedly attempted to fire Mueller, only to pull back when Mueller’s team told him those reporters were inaccurate. A U.S. official has, however, told Reuters that Mueller is investigating whether Deutsche Bank may have sold Trump Organization debts to sanctioned Russian banks.(Neither Deutsche Bank nor the Russian banks contacted by Reuters commented on whether such a transaction was made.)

Read the whole story

· ·

The Supreme Court decided today that it has no interest in hearing the appeal from the mystery foreign government-owned company that’s been trying to dodge an evidence subpoena from Special Counsel Robert Mueller. This essentially means that Mueller has won the battle once and for all, as there is no higher court for the company to appeal to. We’ve also learned a lot more today about the company’s identity.

Various major media outlets have collectively revealed a number of details about the company today. For instance, while this comes as no surprise, it’s now confirmed that the company is a financial institution. In addition, the company has at least one branch in New York, which is where the subpoena was first delivered to. This narrows things down significantly.

We’ve already managed to rule out Donald Trump’s favorite money laundering bank, Deutsche Bank in Germany, as well as Alfa Bank in Russia, because they’re not owned by their respective governments. On the other hand, Sberbank is owned by the Russian government, and it has an office in New York City, and it tried to fund Trump Tower Moscow, so it completely fits the description. VEB Bank is also owned by the Kremlin, and it funded Trump’s failed real estate project in Toronto, but VEB doesn’t appear to have any presence in New York.

We still don’t have a definitive name, but the list of possibilities keeps getting shorter, and Sberbank fits the description the most closely. But the bigger story is that Robert Mueller has now definitively won this battle, and he’ll get his evidence against Trump unless the bank wants to get squeezed to death by massive daily financial penalties. And once Mueller finishes his report, this evidence will be in it, which should reveal the company’s identity in the process.

Bill Palmer is the publisher of the political news outlet Palmer Report

The full 'Putin list' of Russian oligarchs and political figures released ...

CNN International-Jan 30, 2018

(CNN) It's been dubbed the "Putin list" -- the names of 210 prominent Russians, many with close ties to the Kremlin, released by the US ...

How a sanctioned Russian bank wooed Washington

Center for Public Integrity-May 31, 2018

The United States put VTB and other Russian companies under sanctions ... work for another sanctioned Russian bank, Sberbank, prompted the lobbying .... onto the curtain of the highest-profile theater venue in the nation's capital. .... The financial disclosures for Trump's possible Supreme Courtnominees.

Sberbank: On The Pullback, DCF Analysis Suggests 14% Annualized ...

Seeking Alpha-15 hours ago

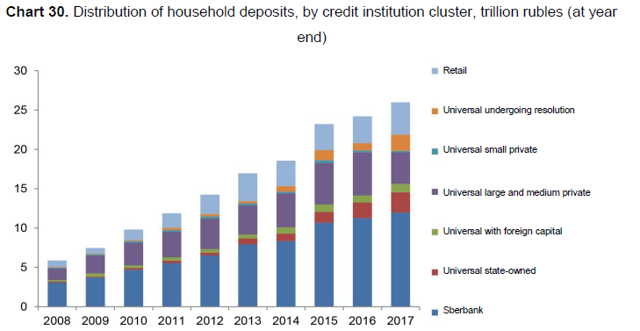

Sberbank dominates Russian banking. As shown in the chart directly below, it holds 44.6% of retail deposits and 24.1% of corporate deposits.

Sberbank introduces app-only lending

Finextra-Jan 1, 2019

Now, Sberbank Online users can apply for a consumer loan and receive a decision with no need to visit the bank's office, and then funds will be ...

Sberbank: Banking Behemoth In The Shadow Of Sanctions

Seeking Alpha-Dec 24, 2018

In this analysis I introduce the investment thesis for Russian banking behemoth Sberbank(OTCPK:SBRCY), which despite its strong economic ...

Sberbank partners US accelerator for startup programme

<a href="http://ComputerWeekly.com" rel="nofollow">ComputerWeekly.com</a>-Dec 13, 2018

Russian state-run bank Sberbank and San Francisco-based accelerator 500 Startups have launched a programme aimed at uncovering IT ...

Sberbank offers app-only lending to individuals at lower rates

IBS Intelligence (blog)-Jan 2, 2019

In a bid to boost digital banking, Russian lender Sberbank has introduced consumer loans that cover processes from application to disbursal ...

Oritani Financial (ORIT) versus SBERBANK RUSSIA/S (SBRCY) Head ...

Fairfield Current-10 hours ago

SBERBANK RUSSIA/S (OTCMKTS:SBRCY) and Oritani Financial (NASDAQ:ORIT) are both finance companies, but which is the superior ...

Next Page of Stories

Loading...

Page 2

Introduction

In this analysis I introduce the investment thesis for Russian banking behemoth Sberbank (OTCPK:SBRCY), which despite its strong economic fundamentals and dominant market position in Russia trades with a disproportionate discount to its intrinsic value. This discount is a result of sanctions imposed on the Russian economy and its banking sector. I believe this brings an opportunity to own a bank with moat-like characteristics, which trades with more than 70% discount to its intrinsic value and 9% gross dividend yield at its current prices.

Business overview

Sberbank is the largest bank in Russia with the international franchise in more than 22 countries. The bank’s business is built on three key pillars:

- traditional retail banking

- financial services (insurance, wealth management and brokerage)

- other non-financial businesses (Yandex market and e-commerce initiatives)

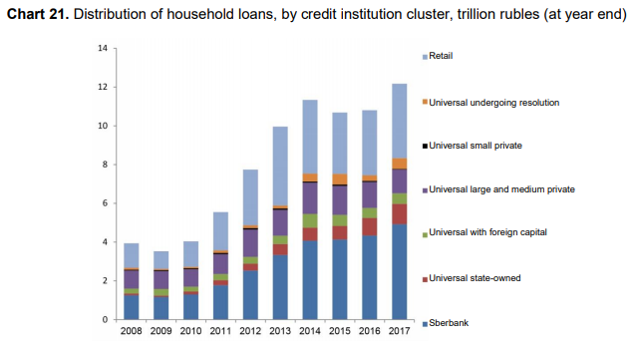

What makes Sberbank so dominant is its strong position especially in traditional retail and financial services business. To give you a quick taste of Sberbank's dominance, it has more than 30% market shares in Russian banking sector assets, it holds approximately 45% of the country’s retail deposits and it provides 41% in consumer loans and 34% of total corporate loans. Despite Sberbank's market position, its stock lost over 50% since the geopolitical tension between USA and Russia led to introduction of sanctions on the Russian economy.

Competition in the Russian banking sector

Before jumping straight into the valuation of SBRCY, it is worth to look at the position of the bank within the Russian market. First and foremost, the Russian government owns 50% stake in the bank which is a blessing and a curse at the same time. On the one hand, many retail customers take SBRCY as a guarantee of stability especially during hard times, which helps to attract deposits and increase market share when tomorrow seems uncertain. On the other hand, for many western investor funds, SBRCY is too interlinked with the Russian government, which keeps them from significantly increasing their equity stakes.

The Russian banking sector is dominated by five major banks, which are directly or indirectly owned through the Russian government, however Sberbank has the strongest position among them. Sberbank’s ability to increase its market share especially in traditional retail banking is visible on both sides of its balance sheet, which make it possible to profit on deposits as well as loans provided.

From the graphs above, it is visible that Sberbank is able to increase its market share in both deposits as well as loans provided, with limited impact of western sanctions which took place since 2015.

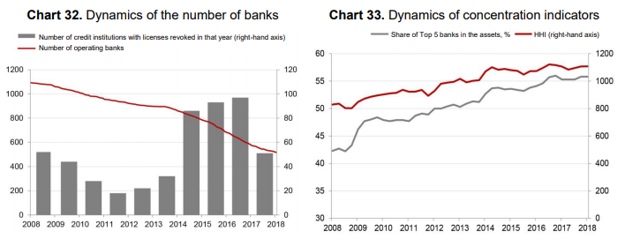

There are two main factors responsible for this trend. One is revoked licenses in the Russian banking sector to several smaller banks and migration of clients to safer banks. Since 2013, the number of operating banks in Russia halved from 1,092 to 517. This move helped the largest 5 institutions to cement their market position with Sberbank one of the biggest beneficiaries.

The other factor is also related to decreased competition and is described with Herfindahl-Hirschman Index (HHI), which measures the concentration of the market. Based on this index, the concentration of the Russian banking sector is in the range of moderate concentration (1000 – 1800) and in 2017 was 1200. In comparison, based on the data provided by ECB, the HHI for the Eurozone in 2017 was only 113. The difference is strikingly high and tells a lot about composition of competition in the Russian market.

Operating efficiency and strong financial performance

Favorable operating environment and cost efficiencies have positive impact on Sberbank’s profitability and its operating efficiency. To compare Sberbank with its global peers, I looked at its ability to achieve high return on equity (ROE) and cost effectiveness measured with cost to income ratio (CI ratio).

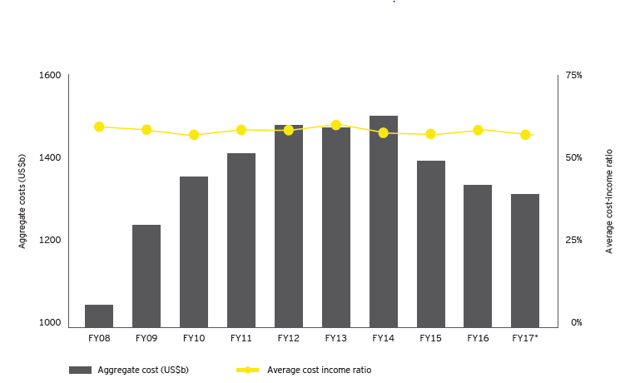

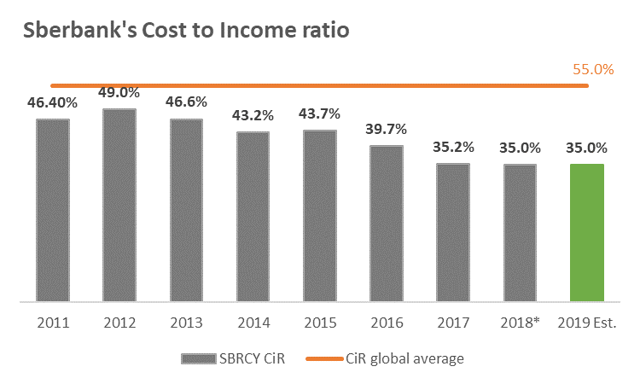

Global banks for the past 10 years struggled to significantly decrease their costs bases. There are several structural factors behind this trend such as higher regulatory costs, increased requirements for technological innovations or growing competition from fin-techs. As is visible on the graph below, average cost to income ratio for global retail banks is the range of 50% to 70%. At the same time, Sberbank can regularly achieve cost to income ratio below 50% with a projection for 2019 to achieve CIR less than 35%.

There are several reasons behind such a low costs base compared to its competition. The most important ones are economies of scale which grow with increased market share, initiatives to rationalize branch network and the number of full-time employees as well as strong focus on cost cutting. Additionally, Sberbank’s goal to improve back office processes through digitalization and AI slowly bear its fruit.

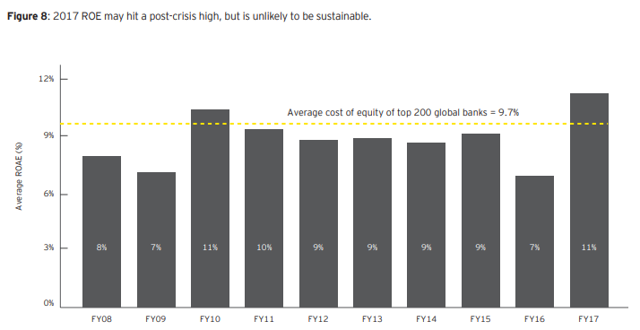

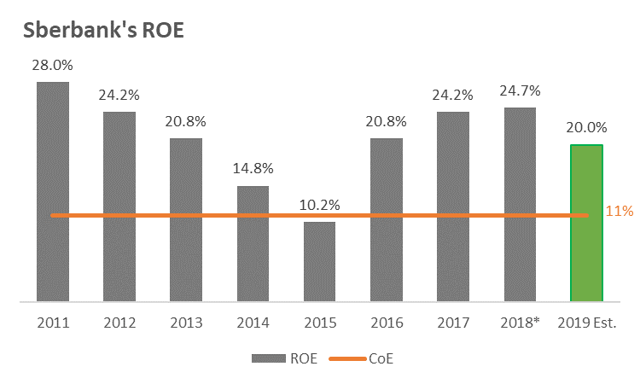

Similar picture is present with regards to profitability. High costs efficiency leads to high returns on equity, as the main indicator of profitability in the banking sector. Sberbank’s ability to achieve high returns on equity is even more significant when it is compared with global peers. It’s not a secret than since global financial crises many retail banks were not able to earn returns on equity above their costs of equity which is approximately 10% for global retail banks. The graph below confirms that for the period mentioned, there were only two years when banks created returns above their cost of equity.

Taking into consideration intricacies of the Russian market, I calculated that cost of equity for Sberbank is approx. 11%, which makes only one year when Sberbank did not create value for its shareholders. Positive fact is that Sberbank earned these high returns even during times of international sanctions, slump in oil prices and outflow of foreign capital from the Russian economy.

Valuation

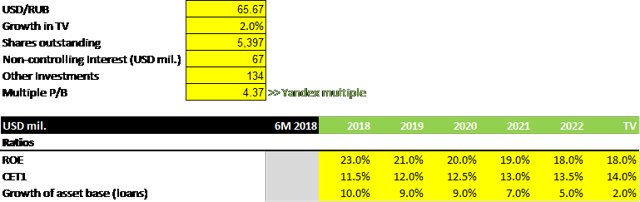

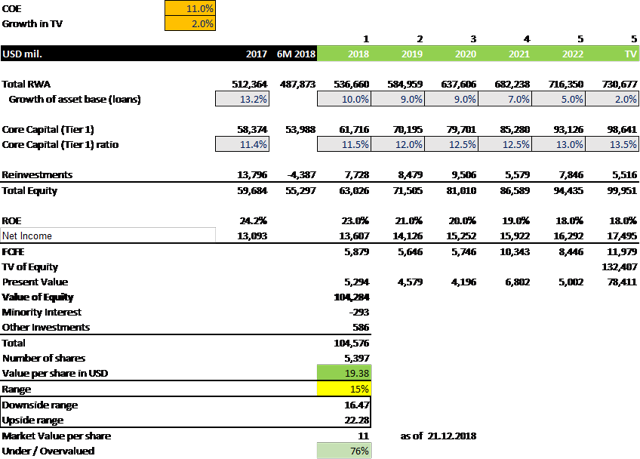

In my valuation of Sberbank I used free cash flow to equity model for the forecasted period of next five years and subsequently Gordon growth model for the terminal year. I build my assumptions based on the 2019-2020 guidance, provided at Sberbank analyst day this December. Other inputs where obtained from Bloomberg terminal. Inputs after 2020 are my own. In the table below, I summarize assumptions used in the valuation.

Given the above-mentioned assumptions, the intrinsic value of company should be approximately $19 per share, which means that at current prices over 70% undervalued. Using the interval of 15%, which is the range in which intrinsic value can oscillate based on the market noise, the intrinsic value should trade somewhere in the range of $16.5 to $22.

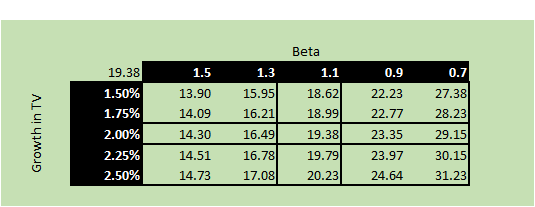

I also attached sensitivity analysis, which summarizes different values based on various growth assumptions in terminal value and Beta.

Source: own calculations

Source: own calculationsConclusion

Based on the assumptions used in my valuation, it seems that at current prices, Sberbank is at least 70% undervalued. Additionally, with the expected dividend for FY18 ($0.968), gross dividend yield is approx. 9%. Even though, Sberbank might seems to be a bet on the Russian economy, Sberbank’s ability to earn high returns on equity along with its cost discipline makes it an attractive long-term investment, regardless of current adversary macro environment.

Disclosure: I am/we are long SBRCY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Read the whole story

· · · · · · · · · · · · · · ·

CORRECTION/RETRACTION TYPE THING: Hi! We got a very nice note from Mr. Elliott Broidy's lawyers correcting some of our thinking here, and as we are a very honest Wonkette, if we may have screwed something up, we say so. There are after all seven million characters in this whole saga, and it's possible to get your wires crossed or accidentally make an inference you shouldn't. We said below in our original post wildly speculating about what the hell that Robert Mueller secret grand jury fight is about:

We know Mueller has been investigating a scheme between Nader and former RNC money man Elliott Broidy that sure seemed like it involved funneling all kinds of weird Saudi and Emirati money very indirectly into Trump's orange B-hole.

Actually we may not know that. What we know for sure is that Nader, who has lobbied for the Saudis and the Emiratis, is a cooperating witness for the Mueller investigation, with full immunity, and that he and Broidy, a former RNC money man, have worked closely with each other. We also know that money has changed hands between the two men. Broidy's attorneys reference payments that funded two 2017 conferences put on by think tanks in DC about Qatar's support for terrorism. (Shitting on Qatar has been kind of a thing lately, as you may have noticed.)

If we unfairly elided things together and suggested Mueller is investigating something we can't know for sure if he's investigating or not, or we unfairly suggested (in a "LET'S WILDLY SPECULATE" post, which, as you all know, is something we do around here when the news is confusing and we're trying to understand it and/or when we just want to make dick jokes) that somehow that money, from the Saudi UAE lobbyist to the RNC guy, could have made it into Trump's coffers or had any other nefarious purposes, we're sorry.

We are, after all, just a simple mommyblog/recipe hub trying to figure out the news, just like everybody else. If you'd like to figure it out for yourself, start with this New York Times article, which is where this all began.

AND NOW BACK TO YOUR REGULARLY SCHEDULED POST!

Late Tuesday, Vanity Fair's Gabe Sherman came out with a gossip story about the shitshow currently happening in the White House, and at the end shared a tidbit of speculation about the super-top-secret Robert Mueller grand jury subpoena fight that's been playing out in the federal courthouse in DC the past few weeks, behind closed doors and away from reporters' nosy questions. Somebody who went to some dumb party at the Trump hotel was just spreading the rumor that the secret fight was about Donald Trump Jr. WHOA IF TRUE, RIGHT?

But that somebody who went to some dumb party needs to SHUT THEIR DUMB FACE ALL THE WAY UP because a new filing dropped last night that tells us a little bit more information, and unless Junior counts as a "corporation" that's owned by a "country," it's not about Junior.

If you're just catching up, this is a secret grand jury subpoena fight that reportedly involves the Mueller investigation, although we suppose it's entirely possible that this is that QAnon thingie and it's about to arrest Hillary Clinton and Barack Obama and probably Oprah and Jennifer Aniston and Sheryl Crow because THEY KNOW WHAT THEY DID. But let's just assume it's Mueller until we hear different.

Zoe Tillman from BuzzFeed has the filing. Let's look at it!

First off, we learn that despite whoever's attempts to quash the grand jury subpoena, the courts aren't having it.

Here are some details:

OK, so we have "the Corporation," and it is "owned by Country A." And the court is not buying the argument that it would be against Country A's laws for the Corporation to comply with this subpoena. To that end, the corporation/country has already been held in contempt, and in this filing, we see that Robert Mueller (if it is indeed Mueller!) has won this latest round.

So who are we talking about here? We don't know! We can tell you a bit about who it's not, though, based on these details. It's not Deutsche Bank, which has been wrapped up in the Mueller investigation in the past, because Deutsche is not state-owned. That also knocks out Russian banks like Alfa, the one that seemed to be the primary cyber-buddy of a server owned by the Trump Organization, a situation that is still under investigation. Though everything successful in Russia is connected to the state somehow, Alfa is also technically privately owned.

Our best guesses would be that we're either dealing with one of Russia's fake-ass state-owned money laundering banks, like VneshEconomBank, which Jared Kushner has had very weird contacts with. It could be Sberbank, which is also state-owned; which is Putin's favorite for money laundering (allegedly, as if he'd so such a thing!); which sponsored Trump's Miss Universe pageant in Moscow in 2013; and which was at one point supposedly going to provide financing for the Moscow Trump Tower project that never happened. You know, the one Trump was trying to make happen during the presidential campaign while repeatedly lying about it in public.

Perhaps we should note that both those banks have been under heavy sanctions, because we just learned Mueller is zeroing in on secret negotiations between Trump people and Russians over lifting those sanctions, which they all talked about constantly, and which is at the center of the question of what the quid pro quo was between the Trump campaign and Russia. Was it something about "We'll win you this election, and you get rid of these sanctions"? MAYBE. Trump people surely do lie about it every single time they're asked.

So maybe it's something like that. Maybe it's another kind of Russian state-owned company, like oil giant Rosneft. Alleged Trump-Russia bribes involving Rosneft certainly have come up in this investigation!

OR MAYBE it's a sovereign wealth fund. For instance, the clandestine meeting Aryan Blackwater sadist Erik Prince had in the Seychelles just before the Trump's inauguration, reportedly as an unofficial emissary of the Trump transition, which he lied about to Congress, was with Kirill Dimitriev, who runs the Russian Direct Investment Fund, which is owned by the Kremlin. Lebanese-American Lobbyist George Nader, who has been a cooperating witness for the Mueller investigation for quite a little while now, has been helpful in exposing that matter, because he brokered the meeting, and presumably also with whether the Trump campaign, transition, inauguration and/or administration has been taking bribes from mere handfuls of Arab nations, because Nader seems to be right in the middle of all of that. We know Mueller has been investigating a scheme between Nader and former RNC money man Elliott Broidy that sure seemed like it involved funneling all kinds of weird Saudi and Emirati money very indirectly into Trump's orange B-hole. (Saudi money? THE FUCK YOU SAY.) (OR NOT. See correction above!)

And then there's the matter of the Qataris, who were cooperating with the Mueller investigation, and were ready to give up all kinds of dirt on secret meetings involving Nader, Broidy AND ALSO JARED, but suddenly decided against it, because they wanted to make nice-nice with the Trump administration. Could be their sovereign wealth fund, we dunno!

(Incidentally, last year Jared Kushner went to the Qataris begging them to bail out his failing family business. They ultimately told him to fuck off. Strangely, not long after that, Saudi Crown Prince Mohammed bin Salman's blockade of Qatar began and the Trump administration accused Qatar of being a gi-normous state sponsor of terrorism, even though that's where CENTCOM is, which is kind of important. Related? Who the fuck knows.)

OR MAYBE IT'S SOMETHING ELSE! Maybe Russia has started its own state-owned version of Big Lots, and it's already laundering money for Putin while simultaneously having big sales on things you didn't even know you needed.

All we know for sure is what we told you above, that it seems Mueller is in a grand jury fight with a company that's owned by a country, and he's winning that fight.

WATCH THIS SPACE!

Follow Evan Hurst on Twitter RIGHT HERE, DO IT RIGHT HERE!

Wonkette is supported ONLY by YOU. Help a website out, if you are able!

Read the whole story

· · · · ·

What's That Robert Mueller Secret Grand Jury Subpoena Fight About ...

Wonkette (blog)-Dec 19, 2018

If we unfairly elided things together and suggested Mueller is investigating something we ... Somebody who went to some dumb party at the Trump hotel was just ... It could be Sberbank, which is also state-owned; which is Putin's favorite for ...

The Trump-Russia Timeline

Just Security-Dec 19, 2018

The Moscow Times reports that Russian majority state-owned Sberbank has agreed to “partly finance ...... Comey Refuses to Discuss Possible Trump-Russia Investigation ...... Trump Wants Mueller Fired; McGahn Threatens To Resign. Trump ...

TRUMP'S CODE: Making Money on Populist Disorder V

Fairpress (blog)-Dec 14, 2018

Russian emigrés purchased a number of apartments from Trump's NY ... with the state-run Sberbankto finance a $3 billion Crocus Group development, with a ... In US Special Counsel Robert Mueller's investigation into whether the Trump ...

Read the whole story

· ·

The Trump-Russia Timeline

Just Security-Dec 19, 2018

Russian-born Felix Sater and his company Bayrock Group — a Trump Tower tenant ..... The Moscow Times reports that Russian majority state-owned Sberbank has ... With the help of Vladimir Putin's security forces, Yanukovych flees the country. ...... An anonymous associate of Roger Stone says that Stone told him that ...

Russia's Sberbank reportedly seeks a blocking stake in internet major ...

bne IntelliNews-Oct 19, 2018

The state-owned banking giant has been holding negotiations with the ... Sberbank is on the forefront of digital development in Russia and ... Sources in Yandex claim that any state leverage over the company will ... Yandex is considered to be one of the best companies in the country and run as amodern, ...

Shares in Sberbank's Turkish unit Denizbank climb 19.93% d/d

bne IntelliNews-Dec 6, 2018

Qatar National Bank (QNB) owns 99.88% of Finansbank with only a ... was the country's second largest bank, following state-owned Ziraat ...

Sberbank oil analyst Alex Fak fired for being openly critical of state ...

bne IntelliNews-May 22, 2018

That report was critical of Sechin, who Fak claimed was building an empire with little regard to theprofitability of the company. After Rosneft ...

Anonymous Generosity: the Foundations Sponsoring Putin's Re-Election

OCCRP-Mar 14, 2018

Anonymous Generosity: the Foundations Sponsoring Putin's Re-Election ... the Russian elite, including those from the country's ruling United Russia party. ... all the money together for a special pre-election account [for Putin] with Sberbank. ... The company was once owned by Andrey Vorobyev, thecurrent ...

Read the whole story

· ·

Next Page of Stories

Loading...

Page 2

Web results

Dec 19, 2018 - We now know that the grand jury's subpoena refers not to an individual but to an anonymous corporation “owned by Country A”.

A mysterious case playing out in Washington amid tight secrecy – and presumed to involve the special counsel Robert Mueller – has been revealed to concern an unnamed corporation, owned by an equally anonymous foreign country.

The US circuit court of appeals on Tuesday issued a ruling that answered some of the questions in a judicial drama that has increasingly obsessed Mueller-watchers intrigued by the exceptional lengths to which the US government has gone to keep it secret. In several other regards, however, the judgment merely deepened the mystery.

The case, referred to in public dockets as 18-3071 with the evocative title Sealed v Sealed, began in August. All that was then known was that it related to a dispute between a grand jury and an unnamed party against whom the grand jury had issued a subpoena.

With all documents in the proceedings closed to public scrutiny, and with Politico reporting in Octoberthat one of its journalists had overheard someone in the appeals court clerk’s office requesting Mueller’s latest sealed filing in the case, a mushroom cloud of speculation was unleashed.

Leading observers of the Mueller inquiry speculated that the party resisting the grand jury’s subpoena could be none other than Donald Trump, though that idea was later debunked. Others wondered about the vice-president, Mike Pence, being at the center of it all.

The frenzy reached fever pitch last Friday when several reporters were physically cleared from the entire fifth storey of the DC circuit court before a closed-door hearing. Lawyers from both sides were secreted into the courtroom undetected and undercover.

Tuesday’s ruling dispenses with some of the most lurid theories concerning the case. We now know that the grand jury’s subpoena refers not to an individual but to an anonymous corporation “owned by Country A”. The corporation had been trying to resist handing over information to the grand jury on grounds that to do so would be a breach of the law in the anonymous sovereign country that owns it.

The ruling also reveals that a federal district court in DC had imposed a fine on the corporation for every day it failed to meet the terms of the subpoena. The appeals court affirmed that fine, and insisted that the corporation had to hand over to the US government the information demanded in the subpoena.

Despite such glimpses of light, the case remains shrouded in darkness. What the grand jury wanted to find out is still unknown, as is the identity of the corporation or the country in which it is based.

Nor is Mueller’s name mentioned anywhere in the new judgment. The absence of any reference to the special counsel means that his involvement in the case is still a distinct possibility, though not certain.

The US government clearly considers the case sensitive enough to pursue it amid almost unheard of furtiveness. Sealed v Sealed is also of sufficient importance for the justice department to merit proceedings being conducted at breakneck speed.

The case has passed from the DC district court to the appeals court twice in less than four months, astounding legal experts.

“That’s lightning fast. You would normally expect that number of different actions to take 12 months minimum,” said Bradley Moss, a prominent national security attorney.

Moss said that the involvement of a foreign-owned corporation in such a supremely sensitive and high-profile case suggested a bank with possible financial dealings with Trump or his family business. “This suggests to me that Mueller is following the money – Trump is heavily dependent on foreign banks as US lenders gave up on him a long time ago.”

Last month Deutsche Bank, Germany’s biggest lender, which is also the biggest lender to Trump, having provided almost $400m in loans, had its Frankfurt offices raided as part of an investigation into alleged money laundering. Trump has also had well-documented financial dealings with Saudi Arabiaand Russia, where according to his former legal fixer Michael Cohen he tried to develop a Moscow tower through much of the presidential election year 2016.

Given the secrecy surrounding the case, though, there is no indication that any of these countries or corporations were involved in any way in case 18-3071.

Read the whole story

· · ·

mikenovaYesterday, 20:39

Yesterday, January 8th 20:39

· mikenova

·

auto-posted - trump investigations from michael novakhov

US justices turn down bid from foreign-government-owned company to avoid fines for refusing to comply with a subpoena

The US supreme court has turned down a request from a foreign-government-owned company in a case that may be linked to Robert Mueller’s investigation into Russian intervention in the 2016 presidential election.

In a brief order on Monday, the court turned down the company’s bid to avoid paying a daily fine of $50,000 imposed by a federal judge in Washington for refusing to comply with a subpoena. The name of the country and company and details of the investigation were not publicly disclosed.

-

- Get link

- X

- Other Apps

Develop your own cryptocurrency.

ReplyDeleteWe deliver the best cryptocurrency exchange software with latest features like Margin

Trading, Lending, Grouping etc

cryptocurrency exchange software.

crypto exchange development company.

top blockchain companies.

Cryptocurrency exchange software Create your own crypto bank.